Have you ever looked at your bank and credit card statements and wondered why they look so different? It is because both of them serve various purposes.

Navigating personal finance can be confusing, especially when faced with documents like bank statements and credit card statements, which many people mistake as interchangeable. While both are essential for tracking financial activity, they serve distinct purposes.

Misunderstanding these documents can lead to costly errors. For instance, some assume a credit card statement is just another version of a bank statement, but the former represents debt, not cash assets.

Others overlook one or the other, risking missed fraud detection or late payments. While both are critical for financial proof—like loan applications—they’re not interchangeable. Lenders often require assessing your cash reserves and debt management habits.

Bank Statement vs Credit Card Statement – Overview

Bank and credit card statements are essential financial records, but they serve distinct purposes. The table below summarizes their key differences to help you understand their roles in managing cash flow, debt, and financial health.

| Parameters of comparison | Bank Statement | Credit Card Statement |

|---|---|---|

| Account Type | Savings, checking, or deposit accounts | Revolving credit account (credit card) |

| Importance | Tracks cash flow, balances, and fraud | Manages debt, credit utilization, and payments |

| Transaction type | Deposits, withdrawals, transfers, fees | Purchases, payments, interest, fees |

| Credit limit | Not applicable (reflects actual cash) | Shows available credit and total limit |

| Interest | Interest earned (on deposits) | Interest charged (on unpaid balances) |

| Payment due dates | No fixed due dates (unless for loans) | Strict due dates for minimum/full payment |

| Frequency of issuing | Monthly/quarterly | Monthly (aligned with billing cycles) |

| Security | Protects against unauthorized withdrawals | Monitors for fraudulent credit purchases |

What Is A Bank Statement?

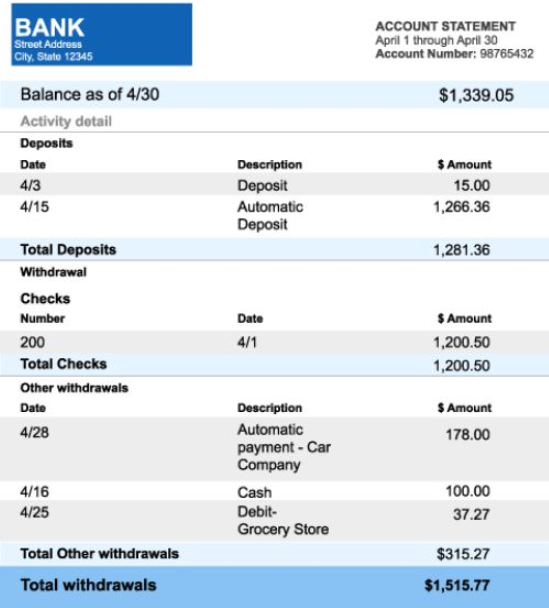

A bank statement is a monthly or quarterly document issued by a bank that summarizes all transactions in a linked account (e.g., savings, checking). It details deposits, withdrawals, transfers, fees, and interest earned, along with opening and closing balances. This statement helps users track cash flow, reconcile accounts, and detect unauthorized activity.

Types Of Bank Statements

Mentioned below are different types of bank statements and how they are used.

- Monthly Statements: Standard reports issued every month, covering all transactions in a 30-day period.

- Quarterly Statements: Less frequent, summarizing activity over three months (typical for low-activity accounts).

- Electronic Statements (e-Statements): Digital PDFs are accessible via online banking, are eco-friendly, and are instant.

- Paper Statements: Physical copies are mailed to customers, which are preferred by those without digital access.

- Mini Statements: Abbreviated versions from ATMs, showing recent transactions (last 10–15 entries).

Key Features Of A Bank Statement

Here are some of the key features of a Bank Statement:

- Lists all transactions (date, description, amount).

- Displays opening and closing balances.

- Highlights bank fees (ATM, overdraft, maintenance).

- Shows interest earned (for savings/deposit accounts).

- Includes account holder details (name, account number, branch).

- Used as proof of income/address for loans or visas.

What Is A Credit Card Statement?

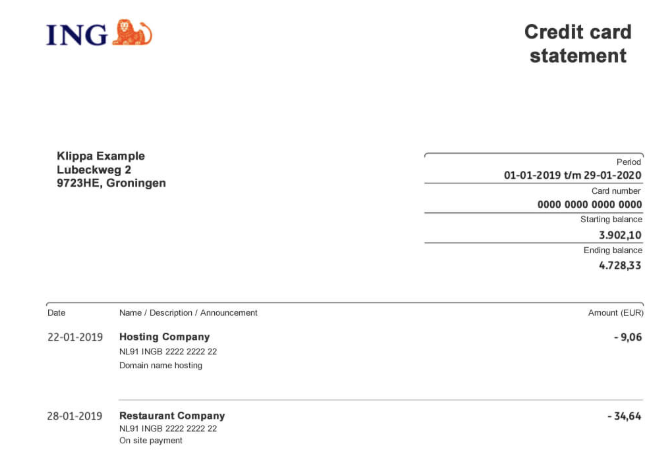

A credit card statement is a monthly summary issued by a credit card provider detailing all transactions, payments, fees, and interest charges during a billing cycle. Unlike a bank statement, which tracks cash deposits and withdrawals, it focuses on credit-based spending, outstanding balances, and repayment deadlines. It also displays the minimum payment due, credit limit, and rewards earned, helping users manage debt and avoid penalties.

Types Of Credit Card Statements

There are various types of Credit Card Statements, which are mentioned below:

- Standard Monthly Statements: Issued every billing cycle (28–31 days), listing purchases, payments, interest, and fees.

- Electronic Statements (e-Statements): Digital versions accessible via the issuer’s app/portal, often with interactive features like spending categorization.

- Business Credit Card Statements: Specifically for corporate cards, highlighting business expenses, employee spending, and tax-ready summaries.

- Balance Transfer Statements: Track debt moved from other cards, showing promotional interest rates and transfer fees.

- Rewards Statements: Focus on earned points/miles, redemption options, and expiration dates (familiar with travel or cashback cards).

Key Features Of A Credit Card Statement

Mentioned below are the key features of a Credit Card Statement:

- Billing cycle dates and payment due dates.

- Total balance owed and minimum payment amount.

- Interest charges (APR) and late fees.

- Detailed transaction list (date, merchant, amount).

- Credit limit and available credit.

- Rewards summary (points/cashback earned).

- Contact info for disputes and customer service.

Bank Statement vs Credit Card Statement – Key Differences

In personal finance, bank and credit card statements are crucial in tracking financial activities, managing budgets, and ensuring financial stability. While they may appear similar at first glance, these two statements serve distinct purposes and provide different insights into an individual’s financial health.

This section breaks down their critical differences to help you optimize your financial health and avoid pitfalls.

1. Significance

Financial statements, such as bank and credit card statements, play a crucial role in personal and business finance management. They provide a transparent record of financial activities, helping individuals and organizations track expenses, monitor cash flow, and plan budgets effectively. Mentioned below are the significance of bank statements and credit card statements.

- Bank Statement:

A bank statement is a comprehensive record of all transactions within a specific period for a checking or savings account. These statements are vital for maintaining overall financial health as they provide a clear picture of income and expenses. By reviewing bank statements, individuals can track their spending habits, set budgets, and identify areas for financial improvement. Additionally, bank statements play an essential role in tax preparation by serving as proof of income and deductible expenses. They also help detect fraudulent activities, ensuring that unauthorized transactions are identified and reported promptly.

- Credit Card Statement:

A credit card statement, on the other hand, is a record of all transactions made using a credit card during a billing cycle. It is crucial for managing credit card debt efficiently and avoiding financial pitfalls. Since credit card usage directly impacts credit scores, timely payments and maintaining a low credit utilization ratio are essential for a healthy credit profile. Understanding the details in a credit card statement, such as interest charges, due dates, and fees, helps individuals avoid excessive debt accumulation and make informed financial decisions.

2. Account Activity

Understanding the differences in account activity between bank and credit card statements is crucial for effective financial planning. While a bank statement tracks actual cash transactions, a credit card statement records borrowed funds, highlighting the importance of responsible spending and timely repayments. Here’s what you need to know:

- Bank Statement:

Bank statements reflect various types of transactions, making them valuable financial documents. These transactions include direct deposits from employers, withdrawals from ATMs, checks issued or received, electronic transfers, and automatic bill payments. Since bank accounts serve as a primary hub for financial transactions, the statement provides a holistic view of an individual’s cash flow, making it easier to manage personal finances.

- Credit Card Statement:

Credit card statements specifically document credit-related transactions, including purchases made with the card, cash advances, balance transfers, and any applicable fees or penalties. Unlike bank statements, which reflect actual cash movement, credit card statements track borrowed funds that must be repaid. This distinction is essential for users to manage their spending responsibly and avoid unnecessary interest charges.

3. Frequency

The frequency of bank and credit card statements plays a key role in financial planning. While bank statements provide flexibility with on-demand access, credit card statements follow a strict monthly cycle, ensuring timely payments and interest calculations. Understanding these differences helps users manage cash flow and debt more effectively. Here’s what you need to know:

- Bank Statement:

Bank statements are typically generated on a monthly basis, providing users with a comprehensive summary of all transactions—deposits, withdrawals, transfers, and fees—within a 30-day period. This monthly cadence aligns with most income cycles, such as salary deposits and recurring expenses like rent or utility bills, making it easier for individuals to track their cash flow and manage budgets. For example, a monthly bank statement helps a user see how a ₹3,000 paycheck is allocated across expenses like groceries, transportation, and savings.

In addition to scheduled statements, banks provide on-demand access to account activity. Users can retrieve mini-statements from ATMs, showing the last 10–15 transactions, or download complete statements instantly through mobile apps or online banking portals. This feature is particularly useful for real-time financial decisions, such as verifying a check clearance before making a large purchase or catching an unauthorized ₹500 ATM withdrawal immediately.

- Credit Card Statement:

Credit card statements follow a fixed billing cycle, typically lasting 28–31 days, after which the issuer generates a detailed statement summarizing all transactions, payments, and fees during that period. For example, a billing cycle running from June 1 to June 30 will have a payment due date around July 20–25, giving cardholders a grace period to settle their debts. Unlike bank statements, credit card statements are issued monthly without exception, as they are directly tied to repayment deadlines and interest calculations.

4. Statement Balance

Knowing statement balances is crucial for financial management. A bank statement balance reflects the actual money available, while a credit card statement balance shows the amount owed. Managing these balances wisely helps budget expenses and avoid unnecessary debt accumulation.

- Bank Statement:

If your bank statement shows a balance of ₹25,000, it means that, at the time of the statement generation, you have ₹25,000 available to use in your account. This includes all the deposits, withdrawals, and pending transactions. If you recently made a ₹5,000 withdrawal or deposit, that amount will be reflected in the balance. Understanding this balance helps you manage your spending and savings.

For example, if you are budgeting for the month, you can use this balance to ensure that your upcoming expenses, like bills or groceries, do not exceed the available funds. If you spend ₹20,000 on your bills, you’ll know that you have ₹5,000 left for the month.

- Credit Card Statement:

Your credit card statement shows a balance of ₹10,000, which means you owe ₹10,000 to the credit card issuer. This could include your recent purchases, such as a ₹5,000 purchase at a clothing store, ₹2,000 for dining, and ₹3,000 in interest or fees.

If you only make the minimum payment of ₹1,000, the remaining ₹9,000 will continue to accrue interest. Over time, if you continue to carry a balance, the amount owed will grow due to the added interest. This is why it’s essential to pay off the entire statement balance whenever possible.

5. Minimum Payment Due

While bank statements do not require minimum payments, credit card statements specify a minimum amount to avoid late fees and interest accumulation. Paying more than the minimum helps in reducing debt faster.

- Bank Statement:

Since bank accounts don’t have a minimum payment requirement, there’s no need to worry about this when reviewing your bank statement. However, it’s essential to check your account for any potential overdrafts or charges.

- Credit Card Statement:

Your credit card statement shows a minimum payment due of ₹1,500. This is the smallest amount you must pay to avoid late fees and maintain your account in good standing. If you don’t make this payment by the due date, you could incur a ₹500 late fee, and your interest rate could increase. Furthermore, if you only pay the minimum of ₹1,500 on a ₹10,000 balance, you will still owe ₹8,500, which will continue to accrue interest.

By paying more than the minimum, say ₹5,000, you reduce the amount that carries interest and help pay off the balance more quickly. This will ultimately save you money on interest charges.

6. Interest And Fees Charged

Bank statements may reflect interest earned on savings or charged on loans, while credit card statements include various interest rates on purchases, cash advances, and penalties. Understanding these charges helps in managing costs effectively.

- Bank Statement:

A bank statement may show interest earned on savings accounts or interest charged on loans. For example:

- Interest Earned on Savings Accounts:

If you have a savings account, the bank may pay you interest on your balance. For instance, if you have ₹50,000 in your savings account and the interest rate is 4% per annum, you would earn ₹2,000 in interest over the course of a year. This interest would be reflected in your bank statement.

Example:

Interest earned = ₹50,000 * 4% = ₹2,000 (for one year). The bank may pay this out monthly or quarterly, depending on the account terms.

- Interest Charged on Loans:

If you have an outstanding loan, such as a personal loan or home loan, the bank will charge interest on the principal amount. For example, if you have a ₹1,00,000 loan at 10% annual interest, the bank would charge ₹10,000 in interest for the year (if you haven’t paid any principal yet).

Example:

Interest on loan = ₹1,00,000 * 10% = ₹10,000 (for one year).

- ATM Fees and Overdraft Fees:

Banks may charge fees for using ATMs outside their network. For instance, using an ATM from another bank could cost you ₹25 per transaction. If your balance falls below the required minimum, you might also incur an overdraft fee, typically around ₹500.

Example:

ATM withdrawal fee (out-of-network): ₹25 per transaction.

Overdraft fee: ₹500 if your account goes negative.

- Credit Card Statement:

Credit card statements typically show various types of interest charges and fees. Here’s a breakdown:

- Purchase APR (Annual Percentage Rate):

This is the interest charged on purchases if you carry a balance from one billing cycle to the next. For example, if you hold a ₹20,000 balance and the APR is 18%, you would be charged interest on that balance.

Example:

Interest on purchases = ₹20,000 * 18% = ₹3,600 (annual interest).

Monthly interest = ₹3,600 / 12 = ₹300 per month.

- Cash Advance APR:

This is the interest charged on cash advances (withdrawing money from your credit card). Cash advances often have higher APRs than regular purchases, sometimes around 24%. If you take a ₹10,000 cash advance, you would pay a higher interest rate on that amount.

Example:

Cash advance interest = ₹10,000 * 24% = ₹2,400 (annual interest).

Monthly interest = ₹2,400 / 12 = ₹200 per month.

- Penalty APR:

If you miss a payment or violate your cardholder agreement, the credit card issuer may impose a penalty APR, often as high as 29.99%. This APR applies to any remaining balance, including new purchases, if the payment is missed or the account becomes delinquent.

Example:

Penalty APR on ₹20,000 balance = ₹20,000 * 29.99% = ₹5,998 (annual interest).

Monthly interest = ₹5,998 / 12 = ₹499.83 per month.

- Other Potential Fees:

Annual Fee: Many credit cards charge an annual fee, which could range from ₹500 to ₹5,000, depending on the type of card.

Example :

Annual fee = ₹1,500 per year.

Late Fee: If you fail to make a payment by the due date, the credit card issuer may charge a late fee. This fee typically ranges from ₹500 to ₹1,000.

Example:

Late fee = ₹750 if payment is missed.

Foreign Transaction Fee: When you make a purchase in a foreign currency, credit card companies may charge a foreign transaction fee, typically 3% of the transaction amount.

Example:

Foreign transaction fee on a ₹10,000 foreign purchase = ₹10,000 * 3% = ₹300.

7. Security

Regularly reviewing both bank and credit card statements helps detect fraud or unauthorized transactions. Banks and credit card issuers provide security features like encryption, fraud monitoring, and zero-liability policies to protect users from financial risks.

- Bank Statement:

Reviewing your bank statements regularly is essential to detect any unauthorized transactions or fraudulent activity. Even if you trust your bank, errors or fraud can happen. By examining each transaction on your bank statement, you can identify discrepancies, such as unfamiliar charges or withdrawals, and report them promptly to the bank.

For instance, if you notice a ₹5,000 transaction you did not make, it’s essential to talk about it immediately to the bank for investigation.

Banks implement various security measures to protect account information, including:

- Encryption: Banks use encryption technologies to secure online banking platforms, ensuring that any sensitive information you share is protected from hackers.

- Two-Factor Authentication (2FA): This requires you to verify your identity using a second method, such as a code sent to your phone, in addition to your password. This makes it harder for unauthorized individuals to access your account.

- Fraud Monitoring: Banks continuously monitor account activity for signs of fraud, such as sudden large withdrawals or logins from unfamiliar locations, and will alert you if anything suspicious is detected.

- Credit Card Statement:

It is equally important to review your credit card statements for unauthorized charges and report them promptly. If you notice any transactions that you did not authorize, such as an unfamiliar ₹2,000 charge from an online store, it’s crucial to contact your credit card issuer immediately. Most credit card companies have a fraud department to handle disputes and may issue temporary credit while they investigate.

Many credit card issuers also provide the following security measures:

- Zero Liability Policy: Most credit cards offer a zero-liability policy for unauthorized transactions, meaning you are not responsible for charges made by fraudsters if reported within a specific time frame, typically 60 days.

- Fraud Alerts: Credit card companies may send alerts via email or text if they detect suspicious activity, such as purchases in different geographic locations within a short period.

- Virtual Credit Card Numbers: Some issuers offer virtual credit card numbers for online transactions. These are temporary numbers that are tied to your account but can be used for one-time purchases, reducing the risk of fraud.

How To Check Your Bank Statements?

There are various ways to check your bank statements, some of which are mentioned below:

1. Online Banking

To access your bank account online, you’ll need to log in to your bank’s online banking portal using your username and password. Most banks provide a secure login page where you can enter your credentials.

Step 1: Log In

Go to the bank’s website and enter your login details.

Step 2: Navigate to Statements

Once logged in, find the “Statements” or “Account History” section, usually located in the main menu or under the “Accounts” tab.

Step 3: Download/View Statements

Select the statement you want to view (e.g., monthly or quarterly). You can view it directly on the screen or download it in PDF format for record-keeping.

2. Mobile Banking App

To view your bank statements through the mobile banking app, follow these simple steps:

Step 1: Open the App

Download your bank’s mobile app if you haven’t already done so. Log in using your credentials.

Step 2: Find Statements

Look for the “Statements” or “Transaction History” section, which may be listed under the “Account” or “Services” tab.

Step 3: View or Download

Select the desired statement and either view it on your phone or download it to your device. Most apps allow you to download the statement in PDF format as well.

3. Physical Statements

If you prefer physical bank statements, many banks offer this option and will send your monthly or quarterly statement by mail. Some banks may charge a fee for paper statements, so it’s a good idea to check with your bank.

If you haven’t received a physical statement or if you need paper copies of past statements, you can request them directly from your bank either through customer service or by accessing the “Statements” section in your online or mobile banking account.

How To Check Your Credit Card Statements?

Mentioned below are the various ways by which you can check your Credit Card Statements:

1. Online Credit Card Portal

To check your credit card statement online, follow these steps:

Step 1: Log In

To access your credit card statements online, start by visiting the credit card company’s official website. Look for the “Login” or “Sign In” button, usually located at the top right corner of the homepage. Enter your username and password to log in to your account. If you are a first-time user, you may need to register your account by providing your credit card number, Social Security number, and other personal information.

Step 2: Accessing and Viewing Statements

Once logged in, navigate to the section labeled “Statements” or “Account Summary.” This section is typically found in the main menu or dashboard. Select the billing period for the statement you wish to view. Most portals display a list of past statements, usually organized by month. Click on the desired statement to open and view it. The statement will show details such as your current balance, transactions, payments, fees, and interest charges.

Step 3: View and Download Statements

Select the statement you want to view (e.g., monthly or quarterly). You can view the statement directly online or download it in either PDF or CSV format for easy record-keeping or importing into financial software.

2. Mobile Credit Card App

You can also check your credit card statement through the mobile app provided by your credit card issuer:

Step 1: Log In

Open the credit card company’s mobile app on your smartphone or tablet. Log in using your credentials (username and password). Some apps may also offer biometric login options like fingerprint or facial recognition. Navigate to the “Statements” or “Account” section within the app. This is usually accessible from the main menu or dashboard. Select the billing period for the statement you wish to view. The statement will display details similar to those on the online portal, including transactions, payments, and fees.

Step 2: View and Download Statements:

Select the statement you want to view (e.g., monthly or quarterly). You can view the statement directly online or download it in either PDF or CSV format for easy record-keeping or importing into financial software.

Physical Statements:

If you prefer physical statements, you can opt to receive them by mail. This option is usually available during the account setup process or can be enabled through the online portal or customer service. Physical statements are typically mailed to your registered address at the end of each billing cycle. Keep in mind that receiving physical statements may take longer than accessing them online, and you should ensure your mailing address is up to date to avoid missing any statements.

Conclusion: Financial Clarity Starts With Understanding Your Statements—Bank or Credit!

It is essential to understand the differences between these documents in order to manage finances effectively. Understanding broader economic concepts improves your financial literacy and allows you to make more informed financial decisions.

Although they both offer essential details about your financial activity, they have different purposes and monitor different kinds of transactions.

Anshu is a content enthusiast with a passion for exploring entertainment and media trends. At YouTrial.TV, he brings his knowledge of streaming platforms and recommendations to help users make the most of their viewing experience. Anshu enjoys staying up-to-date with the latest in the digital world and sharing valuable insights with readers.