The U.S. credit card market continues to break records in 2026 (making us question how much credit card debt is too much), with total credit card debt reaching an unprecedented $1.166 trillion, as per the Federal Reserve Bank of New York.

In this article, I provide key insights into credit card usage, debt patterns, and market trends that shape America’s financial terrain.

So whether you’re a consumer, financial professional, or business owner, these statistics offer valuable perspectives on credit card behavior and industry dynamics.

Top Picks: Facts About Credit Cards Statistics

- The total American credit card debt hit a record$1,373.5 billion in October 2024, marking the highest balance since tracking began in 1999. (Federal Reserve Bank of New York)

- Traditional banks hold most of credit card debt, with depository institutions accounting for $1,211.2 billion of outstanding revolving credit as of October 2024. (Federal Reserve Bank of New York)

- 82% of American adults have at least one credit card, demonstrating widespread adoption nationwide. (GAO)

- Credit card transaction volume in the U.S. surpassed $9.5 trillion in 2022, showing massive payment activity. (Nilson Report)

- The national average APR reached 21.59% as of February 2024 (Federal Reserve).

- 61% of Americans currently hold credit card debt, with 23% reporting increasing debt monthly. (Federal Reserve Bank)

- 543.1 million credit cards were in circulation by Q1 2024, up from 523.2 million in Q1 2023. (Trans Union)

- 47% of credit card holders carry a balance month-to-month (Bankrate)

- 83% of Americans between 30 and 49 years old own a credit card, representing the highest ownership demographic. (Statista)

How Many Credit Cards Does The Average American Have?

- 82% of American adults have at least one credit card, with ownership patterns varying by age and income. (GAO)

- There are more than 500 million open credit card accounts in the U.S., demonstrating the widespread use of credit cards as a financial tool.

- Over 191 million Americans have at least one credit card account, and half of all American adults have at least two cards, while 13% have five or more cards.

- About 73% of Americans have a credit card by age 25, making credit cards the most common first credit experience for younger borrowers. (NY Fed)

- 90 million consumers have only a general-purpose credit card, and 10 million hold only a private-label card. Approximately 90 million have at least one of each.

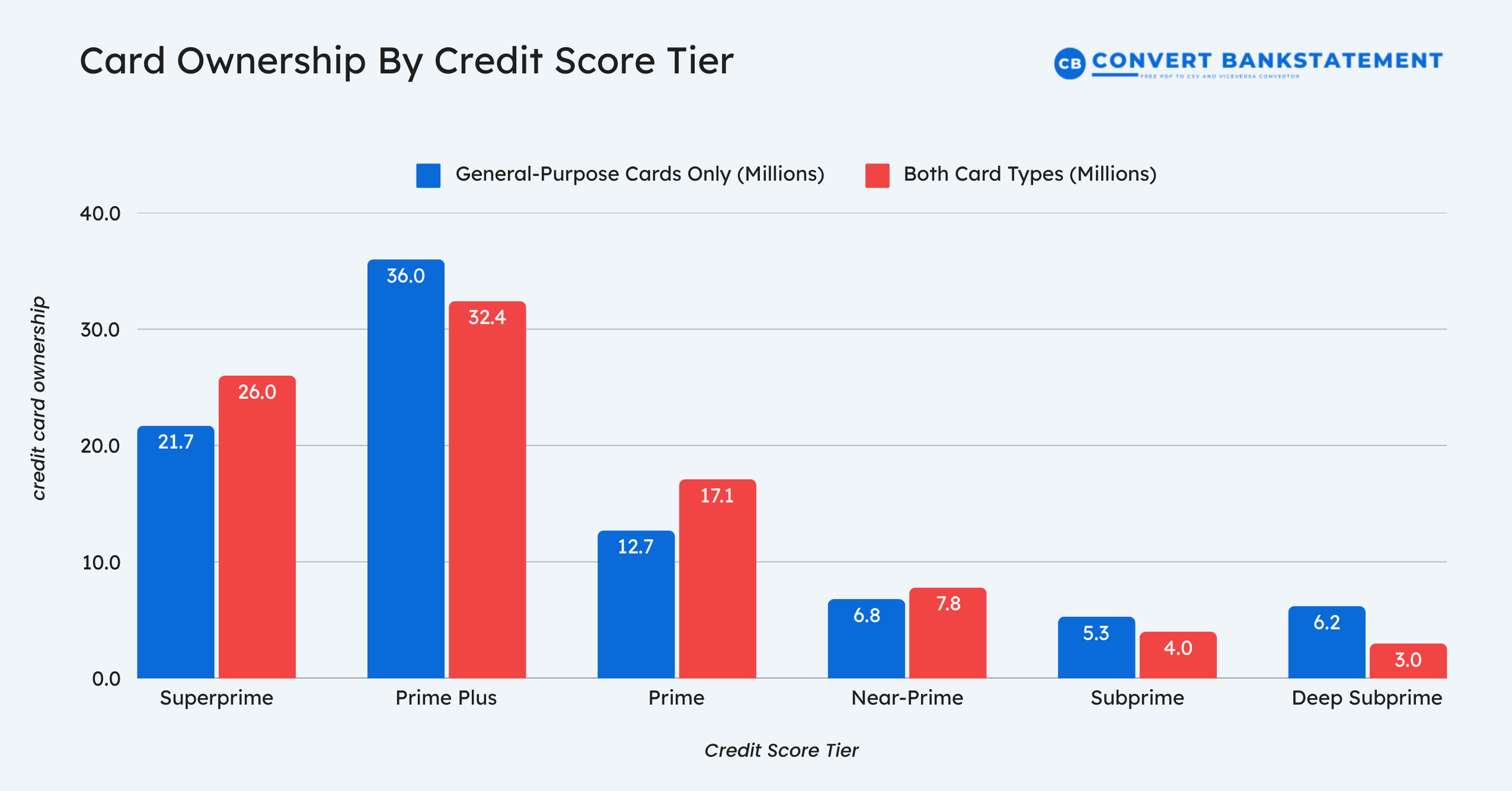

This table breaks down card ownership by credit score tier, showcasing how credit card ownership varies among different creditworthiness levels:

| Credit Score Tier | General-Purpose Cards Only (Millions) | Both Card Types (Millions) |

|---|---|---|

| Superprime | 21.7 | 26.0 |

| Prime Plus | 36.0 | 32.4 |

| Prime | 12.7 | 17.1 |

| Near-Prime | 6.8 | 7.8 |

| Subprime | 5.3 | 4.0 |

| Deep Subprime | 6.2 | 3.0 |

(Consumer Finacial Protection Bureau)

- 97% of households earning $100,000+ have credit cards (Bankrate)

- 57% of Americans aged 50-64 use credit cards, representing the highest adoption rate among all age groups

Here is a table showing credit card usage by age group in the United States:

| Age Group | Share of Credit Card Users |

|---|---|

| 18-29 years | 42% |

| 30-49 years | 49% |

| 50-64 years | 57% |

(Statista)

- 22% of online purchases are made with credit cards. From 2017 to 2023, nearly a third of American customers used credit cards when shopping online (Statista)

- Credit card APRs hit significant levels in 2024, with accounts assessed interest reaching an average of 23.37% by August 2024. (Federal Reserve)

- The average APR across all credit card accounts stood at 21.76% in August 2024, reflecting the impact of Federal Reserve monetary policy. (Federal Reserve)

Average Credit Card Debt In America

- 28% of Americans said their biggest personal debt (not including mortgages) came from their credit card bills in 2024. (Statista)

- 44% of consumer debt in collection reported having at least one credit card debt.

- The share of US credit card debt collections by debt buyers has increased by almost 50% since 2018.

- Top 10 issuers accounted for 83% of credit card debt in 2022, down from 87% in 2016.

Let us check how many Americans have credit card debt! The annual market share by average American credit card debt is as follows:

| Year | Top 10 Issuers (%) | Next 20 Issuers (%) | All Other Issuers (%) |

|---|---|---|---|

| 2016 | 87.0 | 7.6 | 5.4 |

| 2017 | 84.7 | 9.9 | 5.4 |

| 2018 | 84.4 | 10.3 | 5.4 |

| 2019 | 84.2 | 10.4 | 5.4 |

| 2020 | 83.4 | 11.1 | 5.5 |

| 2021 | 83.1 | 11.3 | 5.6 |

| 2022 | 82.9 | 11.6 | 5.5 |

The revenue from debt collection reached $20.3 billion in 2022, with a significant portion coming from US credit card debt collections. (Consumer Finacial Protection Bureau)

- The average debt per cardholder is $5,288 overall.

Let us have a look at what it looks like by credit score tier:

- Deep subprime: $4,453

- Subprime: $4,593

- Near-prime: $4,885

- Prime: $5,048

- Prime plus: $5,173

- Superprime: $5,292

(Consumer Finacial Protection Bureau)

- US Consumer credit card debt statistics show an upward trajectory, with revolving credit increasing at an annual rate of 13.9% in October 2024

- Traditional banks hold most of credit card debt, with depository institutions accounting for $1,211.2 billion of outstanding revolving credit as of October 2024.

- Credit unions manage $84.5 billion in credit card debt, while finance companies hold $18.2 billion. (Federal Reserve)

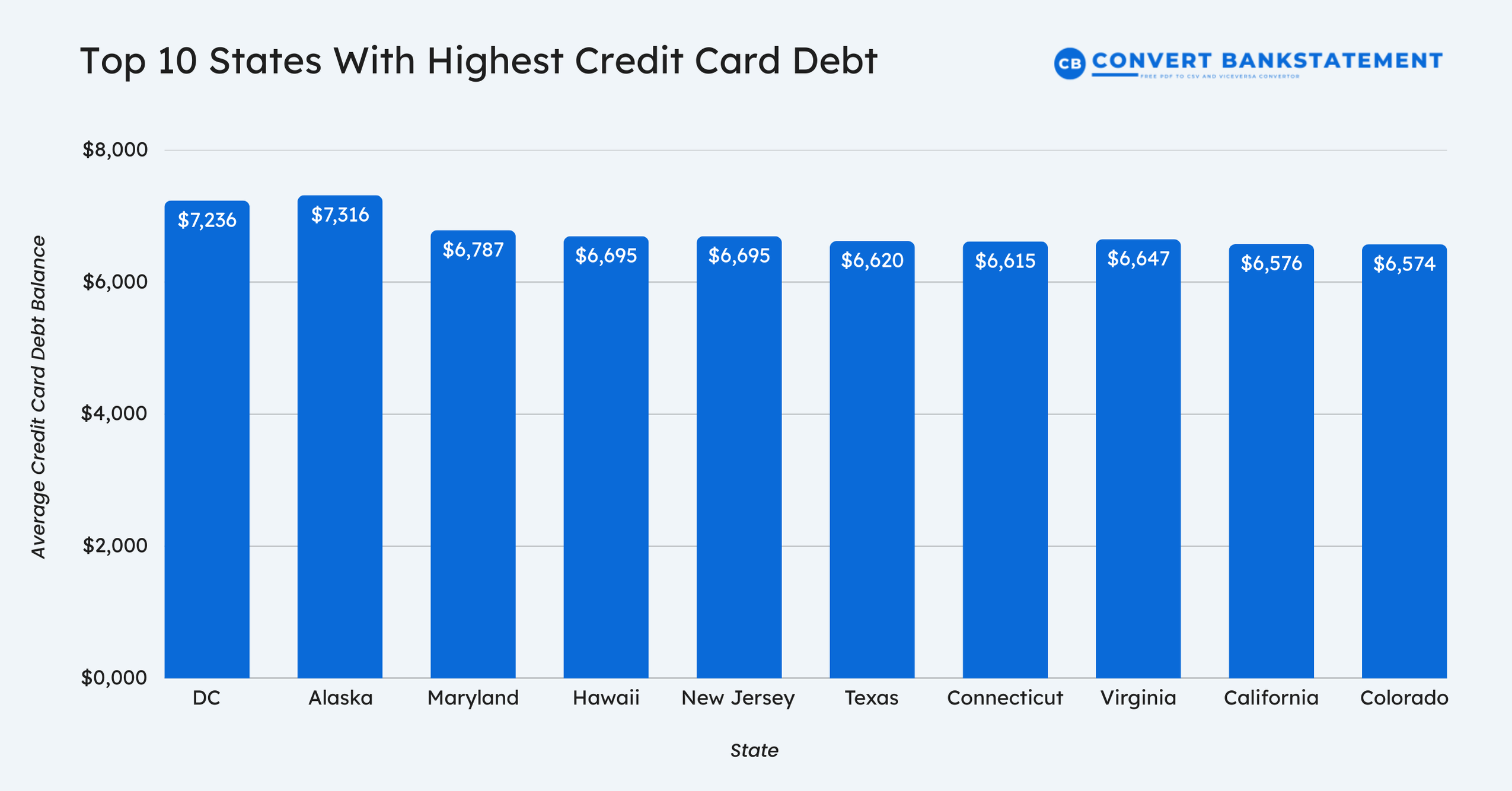

State-Level Credit Card Debt

- It takes DC residents the shortest time to pay off their debt (14 months) despite having among the highest balances.

Here are the top 10 states with highest credit card debt in the USA:

| Rank | State | Average Credit Card Debt Balance |

|---|---|---|

| 1 | DC | $7,236 |

| 2 | Alaska | $7,316 |

| 3 | Maryland | $6,787 |

| 4 | Hawaii | $6,695 |

| 5 | New Jersey | $6,695 |

| 6 | Texas | $6,620 |

| 7 | Connecticut | $6,615 |

| 8 | Virginia | $6,647 |

| 9 | California | $6,576 |

| 10 | Colorado | $6,574 |

- Wisconsin leads with the lowest average credit card debt at $4,940, nearly $1,200 below the national credit card debt average of $6,140

- The Midwest dominates the low-debt list with 6 out of 10 states (Wisconsin, Iowa, Indiana, South Dakota, Nebraska, Ohio)

Here are the top 10 states with the lowest credit card debt in America:

| Rank | State | Average Credit Card Debt |

|---|---|---|

| 1 | Wisconsin | $4,940 |

| 2 | Iowa | $5,063 |

| 3 | Kentucky | $5,098 |

| 4 | Indiana | $5,264 |

| 5 | Mississippi | $5,332 |

| 6 | West Virginia | $5,333 |

| 7 | South Dakota | $5,375 |

| 8 | Nebraska | $5,370 |

| 9 | Ohio | $5,405 |

| 10 | Maine | $5,420 |

- Despite lower average debt, Mississippi has one of the most extended payoff times (22 months) due to lower average household income.

- Massachusetts cardholders pay the least in interest ($714) to clear their debt.

- Kentucky has the third-lowest debt ($5,098) but ranks 49th in household income ($82,614) (Bankrate)

Gender Gaps In Credit Card Statistics

- 60% of men have used credit cards, and 45.3% of women have used credit cards. (Emerald)

- Men experience larger credit limit increases than women, with men’s limit increases being $243 higher on average. (Blascak and Tranfaglia via Fedral Reserve)

- Credit limit increases for men average $2,390, while women receive average increases of $2,147, highlighting a gender disparity in absolute credit limit growth. (SSRN Papers)

- 45.6% of men have experience paying contactless with a smartphone, whereas 41.1% of women have experience with smartphone payments, making men more likely to adopt new payment technologies. (SSRN Papers)

Here is what men and women pay for using their credit cards:

- 32.2% of women handle grocery shopping payments consistently. On the other hand, only 11.8% of men handle grocery shopping payments consistently.

- 46.8% of men always handle taxes and social contribution payments using their credit cards, Whereas 23.1% of women handle taxes and social contribution payments via credit cards. (SSRN Papers)

Credit Card Statistics Across Major Countries

- 66.7% of Americans owned credit cards in 2021, ranking 9th among the listed countries.

Here is a list of the top 10 countries based on credit card ownership based on the latest data from 2021:

| Rank | Country | 2021 (%) | Change From 2011-2021 |

|---|---|---|---|

| 1 | Canada | 82.74 | +10.41 |

| 2 | Israel | 79.05 | -0.61 |

| 3 | Iceland | 74.00 | N/A |

| 4 | Hong Kong | 71.63 | +13.55 |

| 5 | Japan | 69.66 | +5.22 |

| 6 | Switzerland | 69.21 | N/A |

| 7 | South Korea | 68.44 | +12.01 |

| 8 | Norway | 66.74 | N/A |

| 9 | United States | 66.70 | +4.76 |

| 10 | Finland | 65.29 | +1.42 |

- 82.74% of Canadians own a credit card, the highest ownership rate among all countries in 2021

- 13.55% increase in credit card ownership in Hong Kong from 2011 to 2021, showing the largest growth. (Statista)

Consumer Behavior And Payment Trends

- The average credit card interest rate is currently 20.27% by the end of 2024. (Bankrate)

- Credit card delinquency has been increasing post-COVID-19 financial relief expiration. As of Q4 2022:

- 2.1% of general-purpose credit card balances were at least 60 days delinquent

- 3.6% of private label credit card balances reached 60+ days of delinquency in this period. (Consumer Finacial Protection Bureau)

- 8.0% was the highest year-over-year growth rate in the last 10 quarters, recorded in Q2 2022.

Here’s a table showing the last 10 quarters of credit card availability data:

| Quarter | Credit Available (Trillion $) | Year-over-Year Change (%) |

|---|---|---|

| Q3 2024 | 3.82 | 3.82 |

| Q2 2024 | 3.78 | 5.80 |

| Q1 2024 | 3.74 | 6.00 |

| Q4 2023 | 3.66 | 7.40 |

| Q3 2023 | 3.63 | 7.60 |

| Q2 2023 | 3.57 | 7.00 |

| Q1 2023 | 3.52 | 7.40 |

| Q4 2022 | 3.41 | 6.40 |

| Q3 2022 | 3.38 | 7.00 |

| Q2 2022 | 3.33 | 8.00 |

- $490 billion is the total increase in credit availability from Q2 2022 to Q3 2024

- 3.82% is the lowest year-over-year growth rate in the recent period, occurring in Q3 2024

- 7.0% or higher growth was maintained for five consecutive quarters from Q2 2023 to Q2 2024

- $410 billion was added to available credit in just the last year (Q3 2023 to Q3 2024) (Statista)

- $1.36 trillion in credit card transactions occurred in 2023 and is expected to slightly decline to $1.33 trillion by 2027 due to the introduction of new payment trends.

Here’s a breakdown of the global e-commerce payment methods data in a clear table format, focusing on the primary payment methods, including credit cards:

| Payment Method | 2023 Value ($B) | 2023 Share (%) | 2027 Value ($B) | 2027 Share (%) | CAGR (%) |

|---|---|---|---|---|---|

| Digital Wallet | 3,100.00 | 50.0 | 5,400.00 | 61.0 | 14.9 |

| Credit Card | 1,364.00 | 22.0 | 1,327.87 | 15.0 | -0.7 |

| Debit Card | 744.00 | 12.0 | 756.00 | 8.0 | 0.4 |

| A2A | 449.00 | 7.0 | 756.00 | 8.0 | 14.0 |

| BNPL | 316.00 | 5.1 | 442.62 | 5.0 | 8.8 |

(Statista)

Facts About Credit Cards

- There were 53.8 billion credit card transactions in the U.S., averaging 147.5 million per day or 1,708 per second as per the latest data 2023.

- Globally, there were 724 billion credit card transactions in 2023, averaging 22,950 per second.

- The average U.S. cardholder made 251 credit card transactions in 2023, about one every 1.75 days.

- Visa processed 268 billion transactions worldwide in 2023, UnionPay handled 300 billion, and Mastercard processed 175 billion.

- Discover, American Express, and other processors facilitated 21.2 billion transactions in 2023.

- Americans spent $5.2 trillion using credit cards in 2023, which equals $14.2 billion per day or $164,761 per second.

- The average U.S. credit card spending value was $96.49 in 2023.

- The top four U.S. processors facilitated $24.4 trillion in global credit card statistics in 2023.

- In the U.S., credit card data transaction volume equaled $432.99 billion per month or $1.3 trillion per quarter. (Capital One Shopping)

Credit Cards Statistics: Future Trends

- 60% of Visa’s non-US in-person transactions were contactless. Contactless payments are gaining traction due to faster transaction speeds and convenience.

- Over 95% of new POS terminals in the U.S. are equipped for contactless payments. (Credit Cards)

- The share of cardholders paying balances in full has increased to over 40%. One-third of users still pay less than 10% of their balance monthly, although this figure has declined since 2019. (Consumer Finacial Protection Bureau)

Anshu is a content enthusiast with a passion for exploring entertainment and media trends. At YouTrial.TV, he brings his knowledge of streaming platforms and recommendations to help users make the most of their viewing experience. Anshu enjoys staying up-to-date with the latest in the digital world and sharing valuable insights with readers.